Fund of the Year (Jan'26): CalPERS

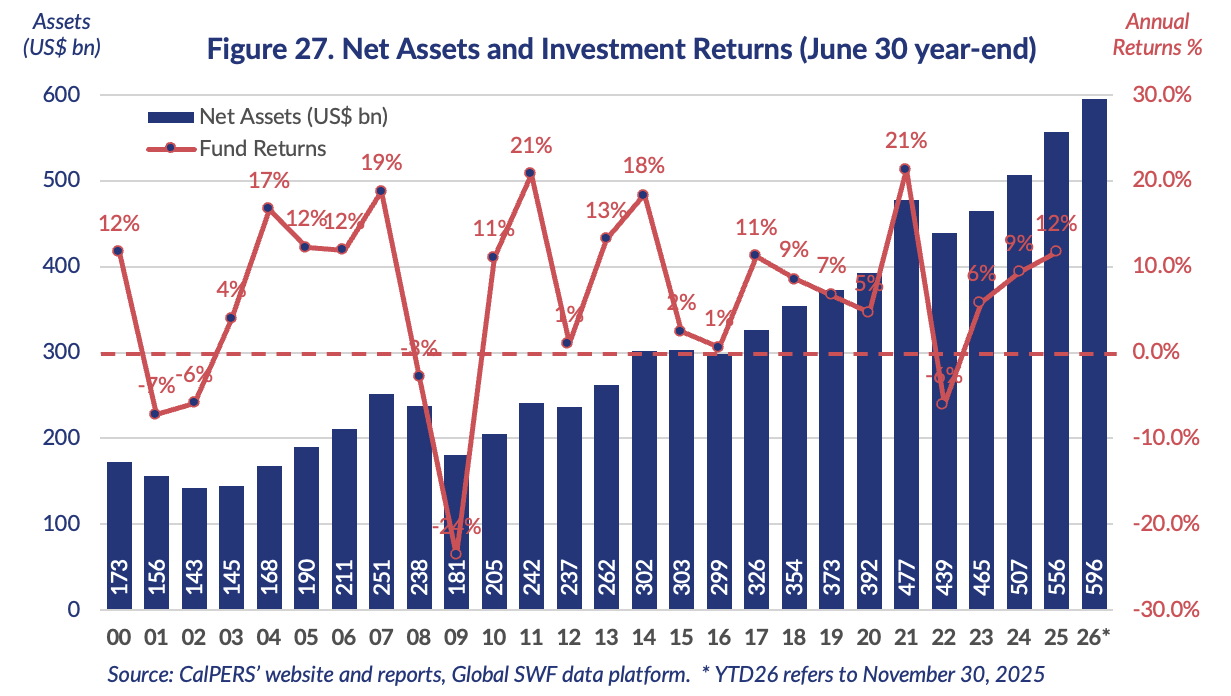

1st January, 2026For its leadership among US retirement systems, for its growing investment and sustainability activity and for its adoption of forward-looking strategies, Global SWF believes that CalPERS is a worthy recipient of the 2025 Fund of the Year award. We were delighted to present it to Stephen Gilmore, Chief Investment Officer of the US$ 596 billion fund, and to speak with him about the fund’s state of play and next ambitions

[GSWF] California has a population of 40 million people, which is aging at a much faster pace than the national average. How well placed is CalPERS to fund the pensions of such aging population?

[CalPERS] CalPERS manages pensions for about 2.4 million members, comprising public employees, retirees, and their families. This is a sizeable population, and we look at demographic trends when monitoring contribution rates, funding ratio, etc. That said, our funding level is about 80% and the most significant change in our recent forecasts has been our inflation expectations, rather than any change in demographics, which were already considered.

[GSWF] In 2025, the in-state portfolio of CalPERS grew to a maximum of 16%, for about US$ 88 billion. Is there any specific goal when it comes to supporting California’s economy and businesses?

[CalPERS] If California were a stand-alone country, it would represent the world’s fourth largest economy, so it is just natural that we have a large exposure to California. In addition, proximity helps when identifying investable opportunities across sectors, and our goal is to achieve the best risk-adjusted return as a fiduciary.

[GSWF] The funding ratio of CalPERS increased from 71% to 79% in the past two years. What is the forecast for the next five years, and what must happen to reach fully funding levels again?

[CalPERS] Our focus is the long-term – we have a discount rate of 6.8% and if we achieve this figure consistently, we would be fully funded again in 20 years’ time. By 2030, we expect our funding ratio to be in the mid-80s, but this will be dependent on the returns we generate and what happens to the projections our team issues.

[GSWF] Since 2022, CalPERS has allowed for a leverage of up to 5%. Do you see this number increasing to levels closer to the Canadian funds? Do you expect CalPERS to issue bonds in the future?

[CalPERS] In addition to the strategic leverage of 5%, the management team can assume an additional 15%, for a total of 20% overall leverage according to the risk levels. We are not considering issuing bonds at the moment.

[GSWF] The performance of the Sovereign Investors that have adopted Total Portfolio Approach (TPA) is a mixed bag. Why do you think this strategy makes sense and will work for CalPERS?

[CalPERS] The most important reason to adopt a Total Portfolio Approach is to align the way you invest with the ultimate objective of the organization – it is a mindset thing. If you are thinking about optimizing the portfolio as a whole, that should conceptually be superior to maximizing asset class by asset class. So, on paper, you should be able to produce superior performance, as long as you have the right collaboration, information systems, and governance in place. According to a study of WTW’s Thinking Ahead Institute, the asset owners adopting TPA would have produced 130 basis points over those funds using a strict asset allocation. These figures are dependent on the chosen sample, risk appetite, currency and other conditions, but regardless of the results, I believe TPA has the potential of optimizing returns by breaking down asset classes silos and focusing more on the overall portfolio.

Future Fund and NZ Super implemented TPA almost simultaneously in 2010, when some Canadian Funds had already done it. Size does not necessarily affect the process but can affect the results, along with other conditions such as liquidity, currency, or location. We at CalPERS believe we have the right conditions to make it work.

[GSWF] In the past five years, CalPERS has almost doubled its weight in private markets from 18% to 34%. Have you now reached an optimal level or are you still aiming at increasing illiquidity further?

[CalPERS] It is reasonable to assume we will continue to increase our exposure to private markets, although it will depend on the opportunities we find, once the risk has been considered. We have done a lot of work to improve our liquidity analytics and management and that has helped facilitate a greater exposure to private markets. We believe we have a number of advantages in asset classes such as Private Equity, where we can be one of the largest and most important Limited Partners (LPs) for our partners and we can leverage that position to create returns.

In addition, we have been investing more in private debt, and infrastructure is a big area of opportunity. We have not ruled out the possibility of investing again in hedge funds, if that adds value to the total portfolio.

[GSWF] Unlike capital markets, private capital asset classes are externally managed, except for a small part in direct / co-investments. Is your aim to internalize these asset classes in the future, too?

[CalPERS] Probably not; private capital is harder to internalize given the resourcing requirements, complexity, etc.

[GSWF] How much of CalPERS’ overall portfolio is invested in the US? Do you see this evolving in the next few years, and what specific countries or regions are you looking at increasing allocation to?

[CalPERS] Over 70% of our portfolio is invested in the US. I don’t have any specific views in terms of specific regions, but we obviously have a natural edge into the US capital markets, given our base currency and location.

[GSWF] Climate Investing has lost some momentum among Sovereign Investors, but CalPERS is on track to have invested US$ 100 billion in climate solutions by 2030. Why is this important?

[CalPERS] Yes, we are on track to the US$ 100 billion mark, and we believe it is important because climate mitigation, adaptation, and transition is a mega-trend, and we would be missing out if we did not invest in them. We do not have a pre-defined set of mega-trends, but this one is staring us in the face and is too big to ignore.

[GSWF] We understand CalPERS may push for more co-investments, both with GPs and fellow LPs. Who do you see as peers among SWFs and PPFs, and what does your ideal partner look like?

[CalPERS] Since 2019, we have been seeking at least 40% of our Private Equity (PE) commitments to be in co-investments. We first achieved that level in 2022, when the PE strategy was implemented under the leadership of Anton Orlich. We have continued to meet those investment goals given the past success and despite the increase in weight of the asset class. And we do that by looking for partners that can have the capability and the alignment.

[GSWF] This year alone, CalPERS has added a new Deputy CIO and a new Head of Private Debt. Is the investment office now complete, or do you still see gaps in the 318-strong team?

[CalPERS] We tend to have a low turnover and mostly cover positions when retirements occur. We are currently in the process of recruiting a new head for the Total Fund team but are generally well covered otherwise.

[GSWF] Will CalPERS open an office overseas in the future, following the footsteps of some of its peers?

[CalPERS] No, that is not something top of mind at the moment.

[GSWF] How important do you think geopolitical risk is for CalPERS at this point in time?

[CalPERS] There was a time when I thought a lot of geopolitics. But in reality, it typically does not have a huge effect on the markets unless there are supply implications or if there were some capital controls as opposed to only tariffs. So, while we must remain alert, it is not a major focus at the moment.

[GSWF] You have been the CIO of CalPERS for 1.5 years now. How do you compare it to your previous roles at NZ Super and Future Fund, and what are your goals for the next three to five years ?

[CalPERS] Every place is different but there are also some commonalities across Sovereign Investors trying to maximize returns. CalPERS is older and larger than Future Fund and NZ Super; the geography is different; and is a pension fund rather than a sovereign fund. But the mission is similar, and the opportunity is huge. One of my main objectives was to deepen the asset-liability management and adopt the TPA. Our scale, information, and depth of talent are huge advantages, and currency is less of an issue, when compared to Canada, Australia or New Zealand.

In terms of future focus, I am always thinking of how to get more from our treasury operations and balance sheet, how to increase diversification and dynamic asset allocation, and of course how to implement the TPA, by increasing collaboration across our teams. We are also embarked in a large initiative to simplify and improve our data and technology, Finally, I always think a lot about culture and succession, which are very important at CalPERS.