Fund of the Month (Oct'25): DP World

1st October, 2025DP World was born in 2005 after the merger between Dubai Ports Authority and Dubai Ports International. A year later, its bid for some ports on the East Coast of the USA indirectly changed the SWF industry forever. In 2007, the company was listed in Nasdaq Dubai and raised US$ 5 billion, MENA’s largest ever IPO then. And in 2020, the company was delisted and went back to the full ownership of sovereign fund Dubai World. Today, DP World is the world’s fourth largest port operator and a highly active and acquisitive state investor.

The portfolio of DP World is well diversified in terms of verticals, including ports and terminals, logistics, and marine services; and regions, which are split into Middle East, Europe and Africa, Asia-Pacific and India, and Australia and Americas. The state investor is a frequent issuer of bonds since 2007, having raised a total of US$ 15 billion through traditional bonds and sukuk in the past 20 years. In 2023, it issued an innovative US$ 1.5 billion green sukuk, and in 2024, it became the first company in the MENA region to issue a “blue bond”.

We were delighted to speak with Anil Mohta, the Group Chief Corporate Finance & Business Development Officer of DP World.

[GSWF] Shortly after its establishment, DP World changed the future of Sovereign Investors, due to its bid for P&O’s US ports – can you please share the journey of DP World and its main challenges?

[DPW] The acquisition of CSX World Terminals in 2005 followed by that of P&O in 2006 turned DP World into one of the world’s largest port operators. However, the P&O transaction faced pushback in the US in light of elections that year. DP World took the “common user” model of Jebel Ali across the expanded global platform, emphasizing commercial credibility, operational excellence, and regulatory transparency.

Over time, we have evolved from a port operator into a global trade enabler with a strong “common user” ethos, creating ecosystems to serve shipping lines and cargo owners, serving multiple customers, not just captive volumes. We have successfully transitioned from a ports company to an global supply chain solutions provider, focusing on diversification across the supply chain with a goal of removing inefficiencies. Our main challenge has been ensuring geopolitical neutrality while deploying long-term capital in sensitive markets. This is something SWFs know well. Along this journey, DP World has faced major challenges including global financial crises, unprecedented levels of consolidation in the shipping industry, COVID-19 disruptions, and today’s volatile geopolitics.

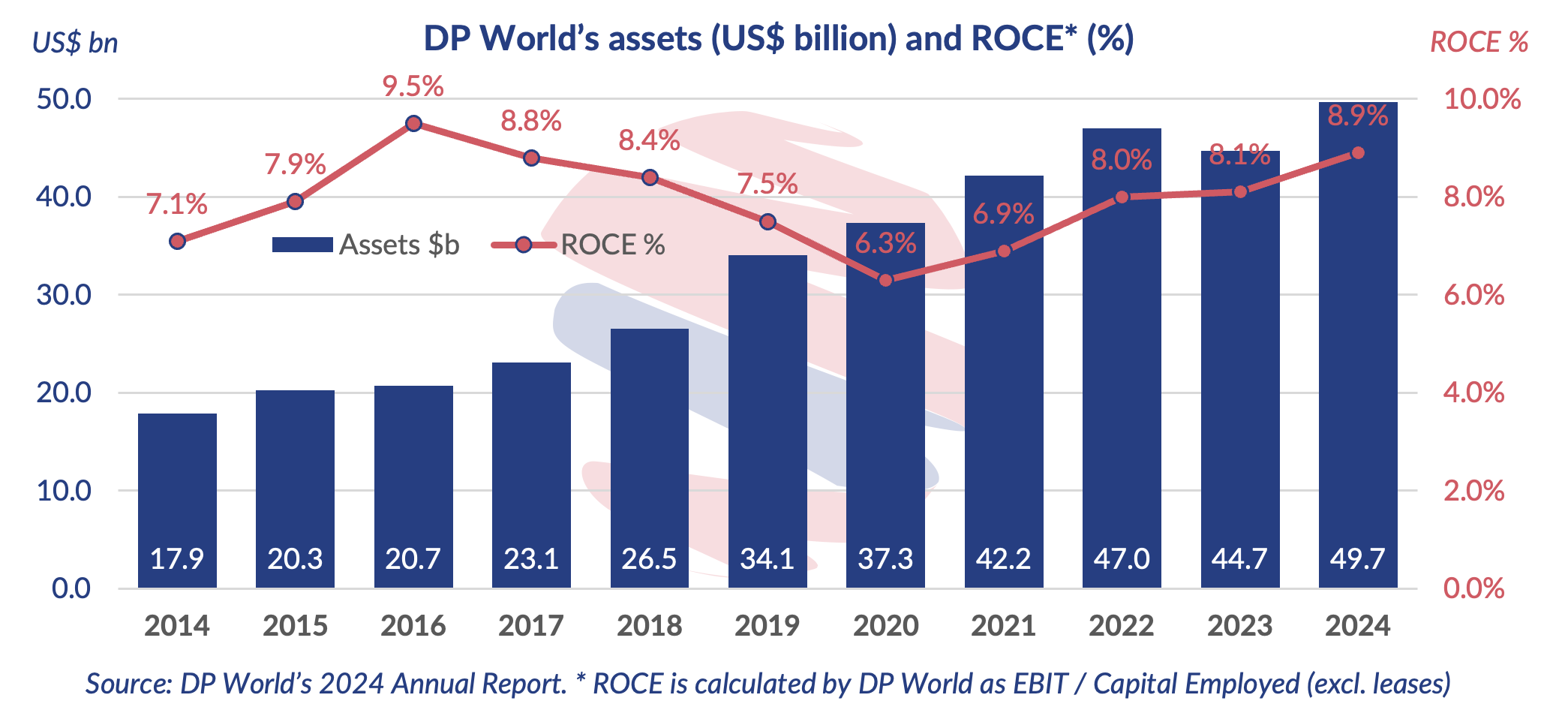

[GSWF] In 2024, the Group continued to reach historical maximums in terms of revenue (US$ 20 bn), EBITDA (US$ 5.5 bn) and assets (US$ 49.7 bn). Where do you see the Group growing to by 2030?

[DPW] Our priority remains to better serve cargo owners while improving our Return On Capital Employed (ROCE) to 15% over the medium term, up from approximately 9% today. We continue to expect strong growth as we build on our position as a leading enabler of global trade infrastructure, particularly across emerging markets and high-growth opportunities. Our expansion efforts are focused on creating a full ecosystem like Jebel Ali and adding new capabilities in logistics, rail, and digital trade platforms that enhance and complement our core ports business.

Our asset base is expected to grow further as we deepen integration across the supply chain. We are investing approximately US$ 2.5 billion annually in organic capex to meet demand-led growth, while also pursuing value-accretive acquisitions that strengthen our capabilities. All investment decisions are guided by a commitment to maintaining our strong investment-grade credit rating, which is essential to our long-term strategy.

High growth opportunities in OECD markets include London Gateway in the UK and Prince Rupert in Canada. Emerging markets also remain a central focus, with Africa, Latin America, and Southeast Asia offering significant opportunities. We are prioritizing resilience, AI-driven efficiency, and climate-aligned infrastructure as part of our long-term development. Our objective is not just to scale up, but to increase our relevance by building inclusive, common-user infrastructure that reduces barriers to trade and unlocks growth across entire economies.

[GSWF] DP World continues to deploy capital in ports from Peru and the UK, to Indonesia, Tanzania and Türkiye. How do you see the balance between domestic and international holdings?

[DPW] The UAE remains our home and strategic anchor. Jebel Ali Port and Free Zone are our flagship assets, and we are fully committed to ensuring that Jebel Ali continues to serve as a globally competitive hub for cargo owners seeking access to key growth markets. Our portfolio is well-balanced, with approximately 75% exposure to emerging or faster-growing markets, including Jebel Ali, and 25% to developed markets. We value this broad footprint and intend to maintain it. That said, our investment approach is demand-led, and wherever customer needs exist and returns are compelling, we are prepared to invest to ensure those needs are met.

Over 80% of our revenue is now generated from international markets, reflecting the scale and success of our global expansion. Our strategy is not based on geographic quotas, but on aligning capital deployment with trade flows and customer demand. This ensures we remain responsive to global economic shifts and opportunities. Wherever possible, we seek to build scale in locations that support multi-modal ecosystems—connecting maritime, rail, road, and digital trade flows—to deliver greater efficiency and resilience across the supply chain.

[GSWF] In 2020, DP World closed a multi-billion partnership with La Caisse that has not stopped growing in importance and size. What constitutes your ideal partner, and do you see more of this happening?

[DPW] Our model works best with partners who share a long-term view and a development-oriented approach. With La Caisse, we have created a platform that reflects long-term alignment, trust, and capital agility. It is a model for infrastructure investment at scale. The partnership is centered on our flagship Jebel Ali assets – Jebel Ali Port, Jebel Ali Free Zone (JAFZA), and the National Industries Park – which together form the most important trade and logistics ecosystem in the Middle East. In 2022, La Caisse acquired a 22% stake in these assets through the JV, valuing them at around US$ 23 billion. This was one of the largest infrastructure transactions ever in the UAE.

The deal achieved multiple goals: it brought in a highly reputable, long-term investor to share in the growth of our crown-jewel assets; it allowed DP World to strengthen its balance sheet while retaining majority ownership and full operational control; and it reinforced Jebel Ali’s position as a regional gateway connecting East–West trade flows. Beyond capital, La Caisse’s involvement brings a strong sustainability ethos and governance framework, which aligns with our own strategy to build climate-aligned infrastructure. Their patient capital matches our vision of building platforms for the next several decades, not just the next cycle. The combination of operational excellence and global capital strength, underpinned by trust and alignment, is the model for infrastructure investment at scale.

Similarly, in 2018, DP World and the National Investment and Infrastructure Fund (NIIF) launched a US$ 3 billion investment platform to invest in ports, terminals, logistics, and related infrastructure across India. The partnership has helped expand multi-modal logistics across the subcontinent—including container terminals, inland hubs, and warehousing—supporting India’s export ambitions. DP World created a US$ 1.8 billion partnership in Australia with Citi Infrastructure Partners (CIP) in 2010, when we sold a 75% stake in our business to CIP. CIP was sold to Corsair Infrastructure Partners in 2017, and we took control back in 2019 buying 35% stake to go back to 60%.

We have also built a partnership with the UK’s development finance institution, British International Investment (BII). Launched in 2021, BII agreed to invest US$ 320 million in existing and future infrastructure projects by DP World in Africa to drive inclusive growth. We already have three projects underway, across Egypt, Somaliland, Senegal and soon the D.R. Congo. All these partnerships allow us to scale responsibly, and unlock impact across emerging trade corridors. The ideal partner would share our long-term vision, commitment to sustainability, and appetite to invest in critical trade infrastructure.

[GSWF] DP World just crossed 100 million TEUs of container capacity in 2024 – how do you see geopolitics and tensions in the region affecting global routes?

[DPW] Red Sea disruptions, US-China decoupling, and Ukraine war have reshaped routing strategies. Customers are increasingly seeking multi-route, multi-mode resilience, a DP World specialty. Our investments in strategic hubs allow rerouting flexibility. For example, Sokhna on the Red Sea, Berbera just outside the Bab el-Mandab strait, and London Gateway serving the UK and northwestern Europe. We expect continued volatility, but also attractive opportunities for diversified operators like DP World.

[GSWF] How important do you think sustainability is for DP World, and can you please walk us through your sustainability goals and progress towards net zero targets?

[DPW] Our Group Sustainability Strategy (Our World, Our Future) is core to our license to operate and grow. We are committed to achieving Net Zero by 2050 across Scope 1, 2, and select Scope 3 emissions. We are partnering with customers and governments to decarbonize full supply chains. We have already achieved major milestones from the electrification of equipment, solar power at key ports, and modal shift programs.

[GSWF] How many employees does DP World have now (investment vs operations), and how do you expect this number to evolve? Do you expect to open more offices overseas in the future?

[DPW] DP World employs over 115,000 people globally across operations, logistics, and technology. An increasing share of employees are in digital, analytics, and logistics, as opposed to traditional port roles. Our future growth will be global, with more innovation hubs and logistics offices abroad. Talent strategy focused on diversity, tech readiness, and local empowerment.

[GSWF] Personally, you have been with DP World for 20+ years. How do you compare it with your previous stint at Port of Salalah, and what are your goals for the next five years?

[DPW] Over the past two decades at DP World, I have witnessed firsthand the incredible transformation of the company, from a leading port operator to supporting cargo owners along their entire supply chain, from end to end. The journey has been truly fulfilling, as I have had the privilege to contribute shaping the strategy and growth of DP World in an industry that continues to evolve.

Comparing it to my earlier career, DP World offers a dynamic environment where the decisions we make each day can impact not just our business but entire trading ecosystems. The scale of our operations and the diversity of markets we serve make the work here immensely rewarding.

Looking ahead, I am focused on driving DP World’s evolution, particularly in areas such as digital transformation, sustainability, and deepening our supply chain solutions. I am particularly excited about the opportunities ahead in emerging markets where we see significant growth potential. Fostering a culture of innovation and building on our strong foundation will be key as we adapt to the challenges and opportunities the future holds for global trade.