Fund of the Month (Nov'25): Oman Investment Authority (OIA)

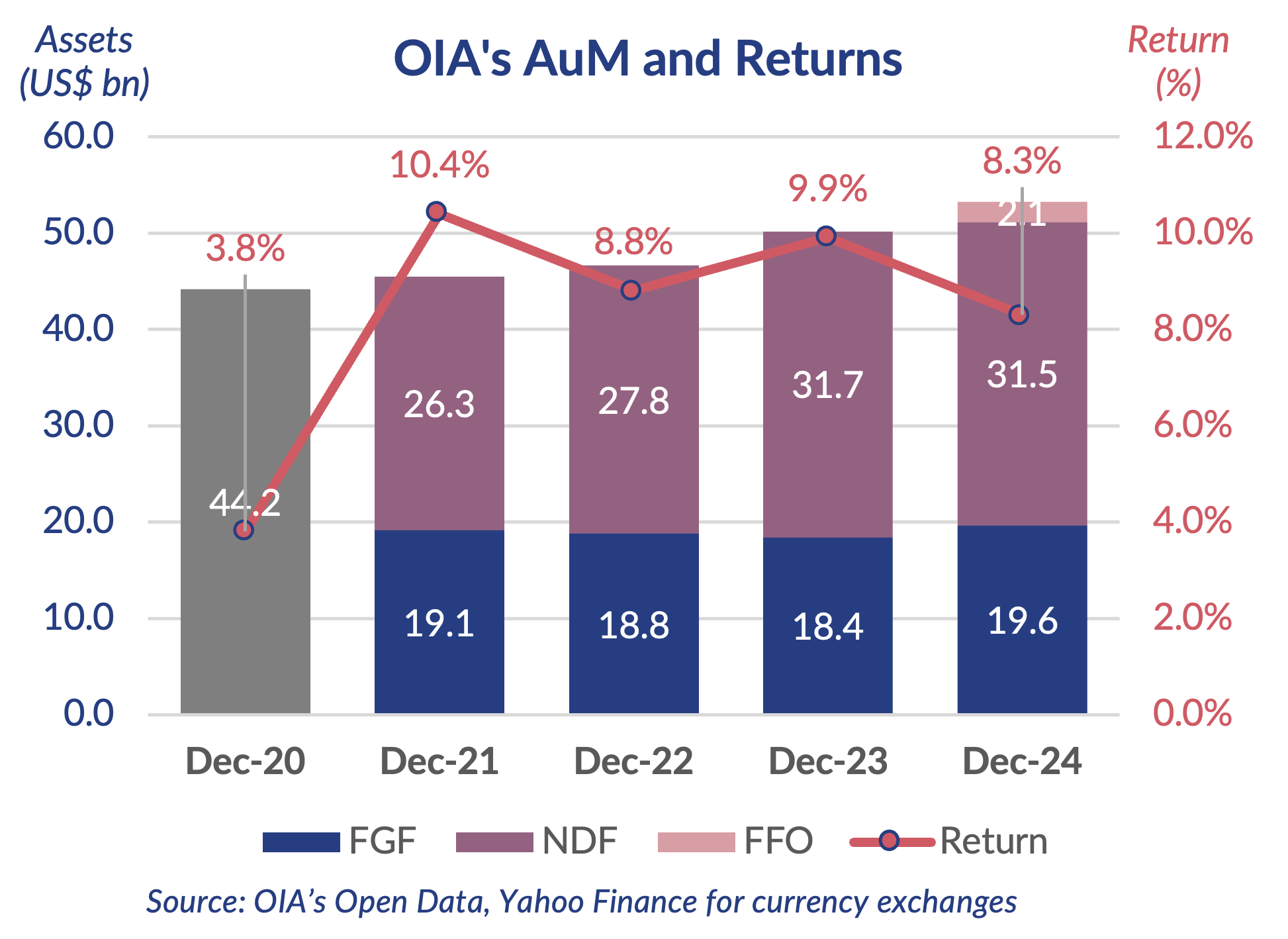

1st November, 2025In 2020, Oman merged SGRF and OIF into a single fund, OIA, which has grown significantly and helped with the reduction of Oman’s debt levels since then. We were delighted to speak with Ms. Samra Al Harthy, the Fund’s Chief Economist and a Board member of the MSX, about OIA’s current setup and future plans.

[GSWF] Can you please share the journey of OIA since its inception in 2020?

[OIA] The merger of the State General Reserve Fund and Oman Investment Fund into a single SWF has proven highly effective for The Sultanate of Oman. It has created a more streamlined and efficient structure, enhanced coordination across sectors. In addition, it has enabled OIA to make well-informed investment decisions and provides it with the flexibility to respond to opportunities domestically and internationally, while remaining aligned with national priorities. Overall, this approach has strengthened OIA’s capacity to deliver robust returns and support Oman’s long-term vision.

[GSWF] How did OIA assist in reducing Oman’s debt levels and upgrading is credit ratings?

[OIA] Strengthening the financial position of OIA companies played a major role in reducing overall debt levels. This was achieved through the implementation of OIA’s policies to enhance profitability and improving cash flow stability. Over-leveraged companies optimized their capital structures by utilizing excess capital to prepay expensive debt and restructure debt to take more favorable interest rates. Additionally, the annual funding requirements of OIA companies were closely monitored. This approach enabled the establishment of leverage limits, ensured the feasibility of funding needs, and safeguarded the ability to meet debt obligations.

[GSWF] Why did OIA launch Future Fund Oman and how has the experience been so far?

[OIA] The establishment of the fund addressed a critical market need and attracted strong interest from both local and international investors. During its inaugural year of operation, the fund invested in more than 40 projects with a value of OMR 1.2 bn, including OMR 333 million in direct investments and an additional OMR 885 million mobilized from private foreign and local investors. FFO is sustaining its momentum in 2025 by focusing on the development of clusters, particularly in renewable energy and healthcare.

[GSWF] OIA has investments in 50+ countries, with Oman representing 61%. Which regions do you expect to grow?

[OIA] We expect to be diversified barring any material changes to expected injections and withdrawals. We expect valuations to dictate marginal changes in allocations and currently flows increasingly favor emerging markets and Europe relative to the US.

[GSWF] OIA divested from six of its assets during 2024. What is the IPO and exit strategy for 2025 and for 2025-2029?

[OIA] In the first half of 2025, OIA completed three divestments, including the IPO of Asyad Shipping. Looking ahead, the 2025–2029 Divestment Plan outlines 30 targeted transactions—comprising 10 IPOs and 20 private placements—across key sectors such as energy, utilities, fisheries, logistics, and technology. The plan aims to generate approximately OMR 1 billion in total revenue.

[GSWF] Your workforce has doubled in five years to 422 employees today. What is the Omanization policy?

[OIA] The employee growth reflects how much OIA has expanded – we feel our current size works well, but we stay flexible to adapt as our needs change. We don’t believe we face major challenges when attracting Omani talent, hence our high Omanisation rate (93%). At OIA, we strongly believe in empowering national talent and providing Omanis with opportunities to grow and succeed.

[GSWF] You are a trailblazer when it comes to female leadership in the GCC. Can you please walk us through your journey, and share any advice for young women aspiring to become a future leader of a SWF?

[OIA] After graduation from university in the UK, I worked in London for a few years. This experience gave me exposure to global financial markets and international best practices as well as provided me with the skills and knowledge that helped in advancing my career. Following that I returned to Oman and joined OIA to establish the Economic research department, which has now expanded to include investment and sector research.

My advice to aspiring women is to focus on delivering high quality work, be a great team player and remain focused on the fund’s goals and objectives, and come up with ideas and initiative to help achieve them.