Fund of the Month (Feb'25): Sweden’s Andra AP-fonden (AP2)

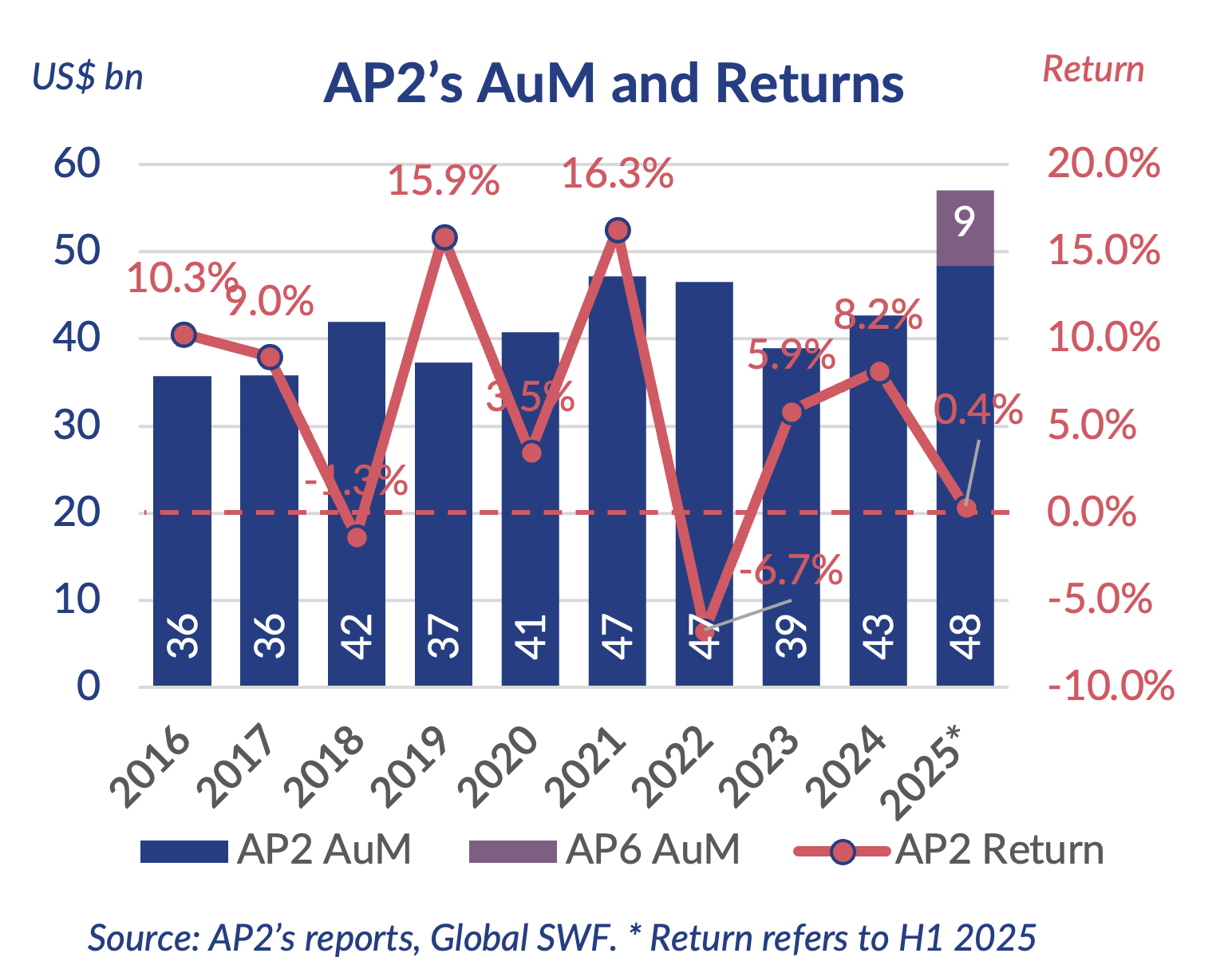

1st February, 2026AP2 is one of Sweden’s buffer funds and plays a key role in safeguarding the long-term sustainability of the national pension system. On January 1, 2026, AP2 officially integrated the capital managed by AP6, a pure private equity play. We were pleased to speak with Ms. Eva Halvarsson (CEO) about the recent consolidation of the AP funds, AP2’s portfolio strategy and its climate objectives.

[GSWF] Can you please walk us through Sweden pension consolidation process?

[AP2] After 25 years under the existing structure, the government decided to streamline the management of the pension system’s buffer capital to improve efficiency, reduce costs and strengthen the system overall. Under the reform, AP1 was consolidated into AP3 and AP4, while AP6 was integrated into AP2. AP2 was tasked with implementing the integration of AP6’s assets and liabilities. This required a full asset-liability review, detailed mapping of AP6’s portfolio and significant operational work, carried out jointly by teams from both funds through dedicated workstreams.

[GSWF] For AP2, this process meant an additional SEK 83 billion (US$ 9 billion). Do you plan to keep your asset allocation?

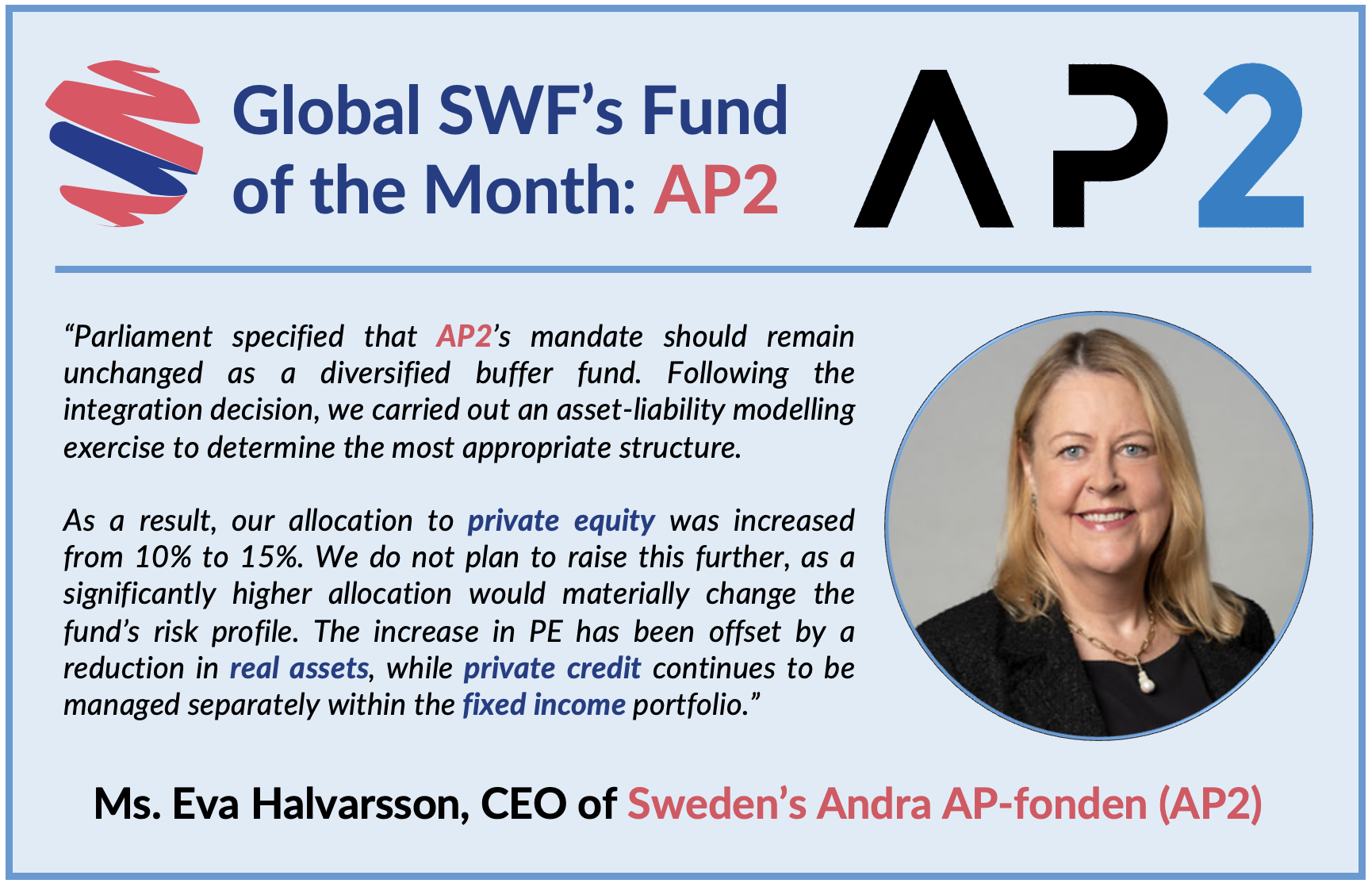

[AP2] Parliament specified that AP2’s mandate should remain unchanged as a diversified buffer fund. Following the integration decision, we carried out an asset-liability modelling exercise to determine the most appropriate structure. As a result, our strategic allocation to private equity was increased from 10% to 15%, which is already relatively high by European standards. We do not plan to raise this further, as a significantly higher allocation would materially change the fund’s risk profile. The increase in PE has been offset by a reduction in real assets, while private credit continues to be managed separately within the fixed income portfolio.

[GSWF] AP2 and AP6 risk profiles and performance were extremely different – how do you plan on bridging the gap?

[AP2] AP2 has also delivered strong results in private equity, with returns of 20.8% over five years and 18.3% over ten years. Our lower overall returns primarily reflect a more conservative interpretation of our mandate and a lower aggregate risk profile. Since 2024, we have been implementing a new investment strategy aimed at improving total portfolio returns, which focused on a more dynamic asset allocation framework. We have also reorganized our investment teams so that equities, fixed income and real assets each combine quantitative, fundamental and private market strategies, encouraging a stronger focus on total portfolio return. This new framework is being rolled out in parallel with the integration of AP6’s assets and is intended to support higher long-term returns.

[GSWF] In 2024, the AP funds wrote off SEK 5.8 billion in Northvolt’s shares and convertible debt. What went wrong?

[AP2] The investment in Northvolt was made jointly with the other AP funds with the aim of achieving financial returns while supporting the climate transition. At the time, demand for batteries was expected to grow rapidly and the company had strong industrial and financial backing. The investment was classified as higher risk. In hindsight, the company may have expanded too quickly across several markets rather than focusing on its initial production facilities. Long-term investors must accept risk in order to support structural transitions, and the experience has provided important lessons without changing AP2’s long-term approach.

[GSWF] AP2 has committed to achieve net zero emissions by 2045. Can you shed light on the trajectory so far?

[AP2] AP2 has developed climate transition plans across all asset classes and defined a pathway to net zero by 2045, including a target to reduce emissions by 35% by 2025 compared with 2019. Reductions so far are broadly in line with this trajectory. Going forward, further reductions must increasingly come from changes within portfolio companies rather than continued portfolio reallocation, which places greater emphasis on engagement and monitoring of company-level transition plans.

[GSWF] AP2’s staff has been constant at 70 people. How many AP6’s staff and offices have been added?

[AP2] AP6 ceased operations at the end of 2025 in line with the parliamentary decision, and its offices in Gothenburg and Stockholm are being closed during 2026. AP2 has recruited around ten new staff across different functions to manage the enlarged portfolio, with around half coming from AP6.

[GSWF] You are retiring after 20 years at the fund. What attributes should your successor have?

[AP2] This is part of a long-standing succession plan, as I am getting closer to retirement age. The focus remains on implementing the new investment strategy and completing the integration of AP6. The board will determine the profile of my successor in due course.