Fund of the Month: Citizens of Israel Fund (CIF)

1st August, 2025In 2022, Israel formally established CIF, a traditional SWFs sourced from natural gas revenues, and with clear mechanisms for deposits and withdrawals, in order to provide macroeconomic stability and save for future generations. We were delighted to speak with Ms. Lena Krupalnik, the Fund’s Head of Management Department, about CIF’s current portfolio and strategy, and future ambitions.

[GSWF] The CIF Law was passed in 2014, but the fund only started in 2022. Can you please share the journey of CIF and what the main challenges have been?

[CIF] The Fund officially began operations in June 2022, once the accumulated revenues reached NIS 1 billion. The journey involved building a robust legal, operational, and governance framework, while ensuring alignment with best practices.

Two of our main challenges were recruiting a highly skilled and dedicated team, and operating as a startup within a large and bureaucratic institution. We had to balance agility and innovation with the procedures of an established public body — building something new from within, while navigating complex organizational dynamics.

[GSWF] According to CIF’s website, it could receive up to US$ 72 billion in levies. What are CIF’s long-term ambitions?

[CIF] CIF is financed through a levy on excess profits from the extraction of natural resources, primarily natural gas. This levy increases progressively as projects become more profitable, meaning that inflows to the Fund are expected to grow gradually over time. According to forecasts by the Israel Tax Authority, a significant rise in revenues is expected within the next two years, and in about five years, annual inflows are projected to reach approximately US$ 2.5–3 billion. Our long-term ambition is to build a resilient SWF that serves future generations, supports macroeconomic stability, and contributes to intergenerational equity.

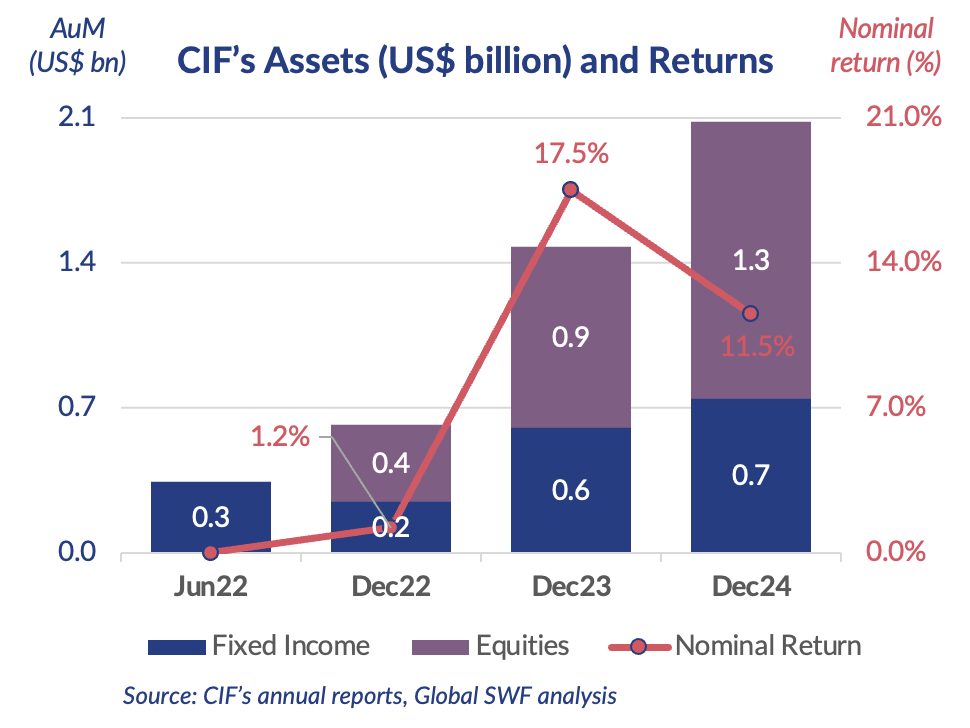

[GSWF] CIF started with a traditional asset allocation of 60/40 – how may this strategy change in the years to come?

[CIF] Following a thorough review and based on data and analysis presented by the investment team, the Investment Committee and the Fund Council decided at the beginning of last year to increase the Fund’s risk profile to a 70/30 allocation. This decision reflects the Fund’s long-term horizon and its mission to manage the assets for the benefit of future generations. As the Fund matures and assets grow, we are gradually diversifying into private markets, to enhance returns and reduce correlation with public markets.

[GSWF] In July 2025, CIF closed its first investment in private markets. Can you share what kind of commitment it was?

[CIF] Our first private market investment was in the emerging field of Private Debt Secondaries, following 18 months of intensive preparation. In line with our allocation model, this year we are focusing on fund investments across private debt and equity. In PE, we plan to allocate a significant portion to Secondaries, where we currently see compelling opportunities. We believe this segment offers diversification in terms of managers and vintages, and enables faster capital deployment as we build a new portfolio.

[GSWF] How many employees does CIF have now, and how do you expect this number to evolve in the near future?

[CIF] As stated in the CIF Law, the Fund is managed by a dedicated division within the Bank of Israel, which ensures operational excellence and financial integrity. The Fund currently operates with a lean team within the central bank, but we anticipate gradual growth in staff as our investment scope expands, particularly in investment analysis, risk management, and operations.

[GSWF] 75% of CIF’s portfolio is in the United States. Does your mandate allow you to invest domestically?

[CIF] The Fund’s investment policy is globally oriented, and the high exposure to the US reflects market depth and liquidity. The Fund is not permitted to invest domestically.

[GSWF] Personally, you have led CIF since inception. How do you compare it with your previous career, and what are your goals for the next five years?

[CIF] Leading CIF has been a unique and meaningful experience, combining public service with long-term financial stewardship. Compared to the private sector, the mission here is broader and more future-oriented. Over the next five years, my goal is to solidify the Fund’s foundations, expand its global presence, and ensure it becomes a source of pride and stability for all Israelis.