Fund of the Month: Baiterek National Managing Holding JSC

1st September, 2025In 2013, Kazakhstan spun off the portfolio of financial institutions from Samruk-Kazyna and established another SWF, Baiterek, which has evolved significantly since then. We were delighted to speak with Mr. Timur Onzhanov, the Fund’s Deputy Chairman of the Management Board, about Baiterek’s strategy and plans.

[GSWF] Can you please share the journey of Baiterek since its inception in 2013?

[BNMH] After inception, Baiterek restructured its assets, reducing its companies from 14 to 7, and in 2021, it expanded its mandate into agriculture with three subsidiaries of KazAgro. In addition, the institution unified its governance policy, implemented a digitalization strategy, a performance-based evaluation system, and an integration of ESG approach. This came with a set of challenges: the implementation of a difficult mandate through diverse measures, aligning entities with differing corporate cultures, balancing social objectives with financial sustainability, and adapting to external economic and geopolitical conditions. Today, Baiterek is a modern development institution focused on results and contributing to Kazakhstan’s sustainable future.

[GSWF] Baiterek manages important subsidiaries, including DBK and QIC. What can you tell us about them?

[BNMH] DBK supports businesses through lending, guarantees, co-financing, participation in syndicated loans, and leasing. 2024 was a record-breaking year for the bank, which allocated USD 3.1 billion to 58 investment projects. On the other hand, QIC focuses on fostering economic growth and diversification through the establishment of private equity funds and attracting direct investment. In 2024, the fund signed strategic agreements with partners from the UAE and Singapore, and financed 11 new projects.

[GSWF] What are Baiterek’s priorities in the context of the 2024-2033 Strategic Plan? Will there be more privatizations?

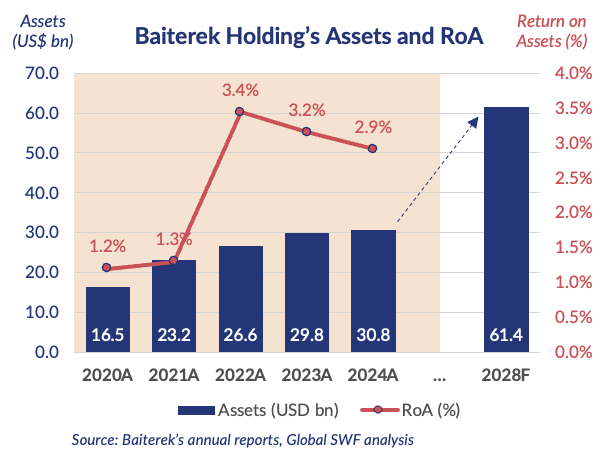

[BNMH] To support the Government’s objectives, the Holding has been mandated to attract USD 17.5 billion in funding to support entrepreneurship, housing development, and the implementation of key projects. This would enable a 2.6x increase in the revenue of enterprises supported by the Holding by 2033. Export revenue of supported enterprises is also projected to grow 2.2x by 2033. Overall, the Holding’s contribution is estimated to account for 1.3 percentage points of the targeted 6% annual GDP growth.

[GSWF] In June 2025, Baiterek met with CIC and CDB among others, in China. What can you tell us about this visit?

[BNMH] China remains one of Kazakhstan’s key partners. As of the end of 2024, trade turnover between the two countries reached a record high of USD 44 billion. Currently, the Holding is working with several Chinese institutions, including CICC, CDB and ICBC. For example, the latter provided us a long-term loan of CNY 500 million, and our subsidiary DBK is signing a US$ 1 billion agreement with CDB. In addition to China, we also aim to expand our strategic cooperation with partners in the Middle East, Europe, and Asia.

[GSWF] How many employees does Baiterek have now, and how do you expect this number to evolve in the near future?

[BNMH] As of today, the headcount stands at 4,112, including 136 in the central office. These numbers are expected to remain relatively stable, depending on the scale of tasks assigned to the Holding and on priorities set by government policy. Digitalization and centralization of service functions may lead to workforce rationalization or increased productivity – but also, the implementation of new government programs, expansion of functions, or institutional initiatives may require strengthening our staff.

[GSWF] Personally, you have been with Baiterek for over a year now. How do you compare it with your previous role at AIFC? What are your goals for the next 5 years?

[BNMH] At the AIFC, my focus was on developing the asset management market, attracting international capital, and building strategic partnerships. Joining Baiterek in 2024 was a natural progression – from forming financial infrastructure to its practical application in support of economic growth.

My objectives for the next five years include strengthening the Holding’s global investment presence, developing partnership mechanisms with SWFs, multilateral banks, international financial institutions, and expanding the Holding’s involvement in sustainable finance. I aim to further strengthen Baiterek’s role as a key institution for promoting sustainable growth of the domestic economy.